FTC Pays Attention to Dealership Advertising—Do You?

A new advertising campaign can be a great way to drum up business for your auto dealership. If you’re not careful, though, it can be an even better way to get in trouble with the Federal Trade Commission.

In recent months, the FTC has cracked down on dealer advertising violations.

First, there was the FTC’s announcement of a $1.5 million settlement against a New York-based dealer and its general manager. The business allegedly ran ads that misrepresented prices, misidentified vehicles as Certified Pre-Owned, and failed to comply with Reg Z disclosure requirements—among other violations.

Then, a dealer marketing firm is facing charges for allegedly sending mailers encouraging consumers to “claim” a “prize” which the recipients had a 1-in-52,000 chance of actually winning. This is the firm’s second FTC violation that year, after they were charged for purportedly misleading customers under the guise of COVID-19 stimulus relief.

Seriously, dealers and marketing firms, don’t do stuff like this. It can cost your business upwards of 5 or 6 figures when the FTC finds out.

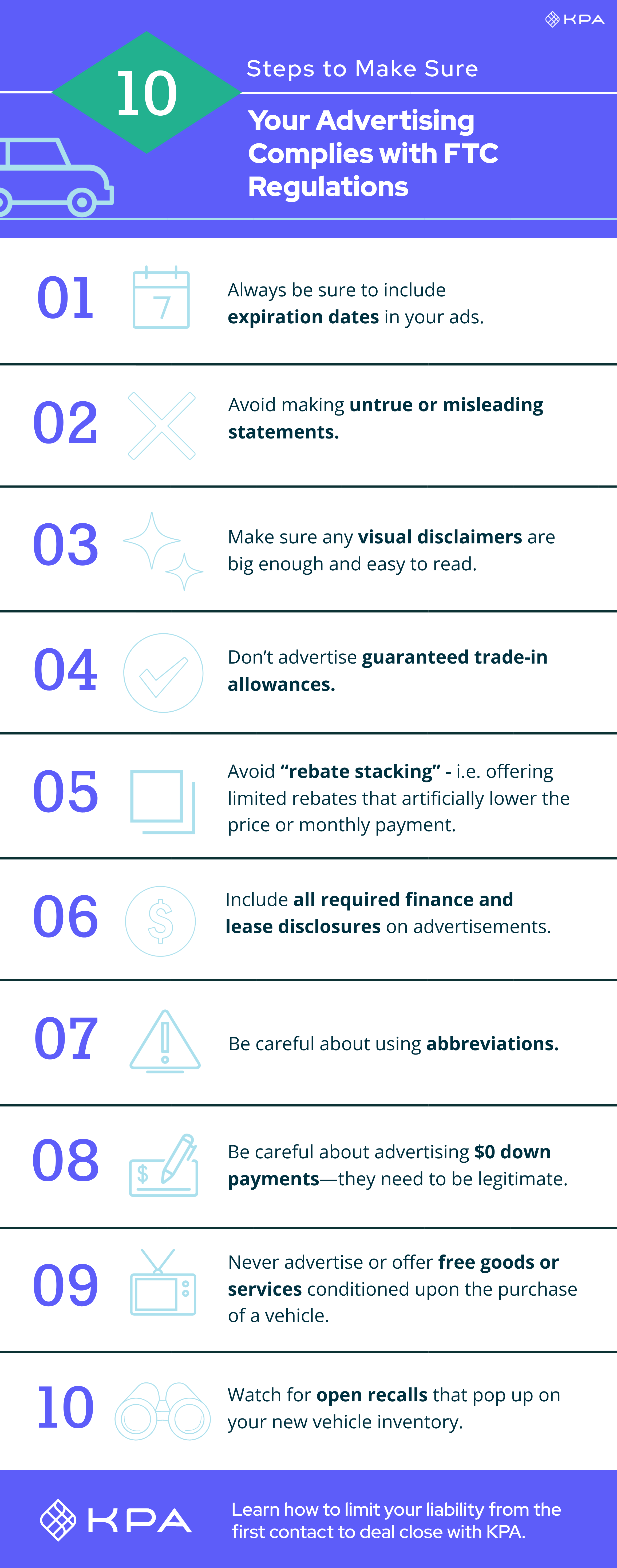

How can you ensure your advertising is in compliance with FTC regulations?

For one, maybe don’t send out fake stimulus checks during a pandemic (or ever). Here are a few more tips from our auto compliance experts:

1. Always be sure to include expiration dates in your ads.

2. Avoid making untrue or misleading statements.

3. Make sure any visual disclaimers are big enough to read, easy to understand, and placed in a prominent area near an advertisement’s claim.

4. Don’t advertise guaranteed trade-in allowances.

5. Avoid “rebate stacking”—i.e. offering limited rebates that artificially lower the price or monthly payment of a vehicle for which very few, if any, consumers would qualify because they do not qualify for all the rebates or the rebates conflict with one another.

6. Remember to include all required finance and lease disclosures on advertisements.

7. Be careful about using abbreviations.

8. Be careful about advertising $0 down payments—they need to be legitimate.

9. Never advertise or offer free goods or services conditioned upon the purchase of a vehicle.

10. Watch for open recalls that pop up on your new vehicle inventory.

Advertising compliance is just one area KPA can help dealers maintian compliance with a whole host of dealership regulations. Check out Vera F&I and learn how to limit your liability from the first contact to deal close. If you have any questions or need further guidance on this or any compliance-related matter, KPA’s auto team is here to help. Contact us.