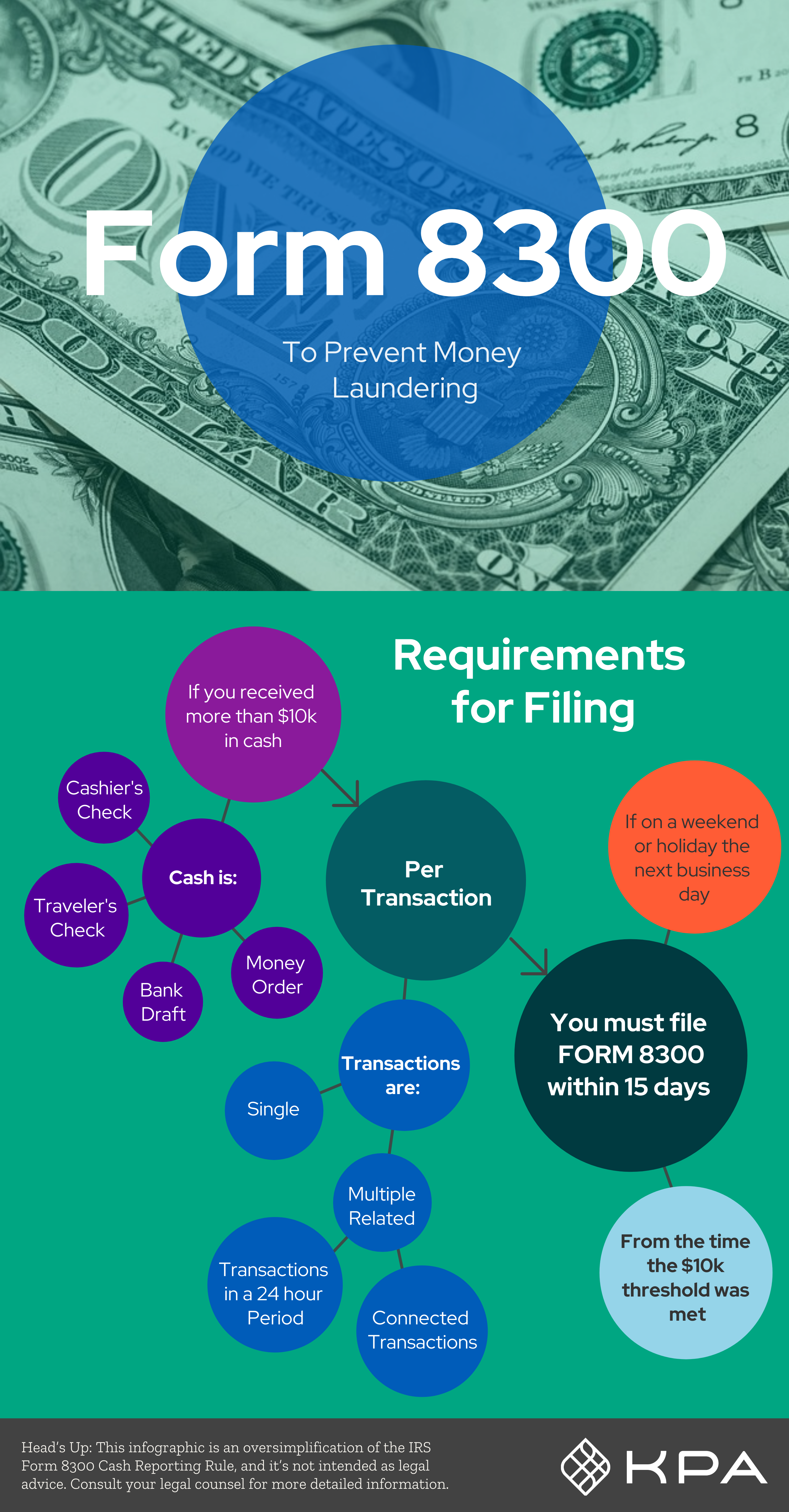

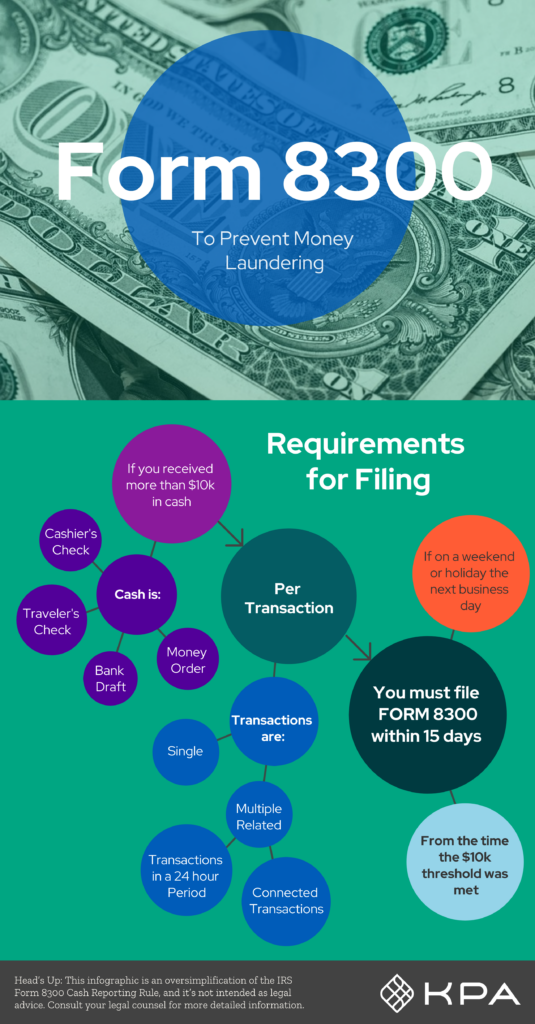

Form 8300 Cheat Sheet: When Should I Report Suspicious Activity?

As a dealer, you need to know that a cash transaction of $10,000 and higher should be considered suspicious. The government certainly does. The IRS Form 8300 Cash Reporting Rule is enforced by both the IRS and the US Patriot Act.

WHY is $10,000 suspicious?

Drug dealers and terrorists often have large amounts of money they don’t want tracked. So the solution is to launder the money by making purchases with “dirty cash.” In the past, these cash payments have been unquestioned by dealerships but it is now the law to report such transactions.

WHY should I report it?

Besides wanting to simply make the world a better place you should submit IRS Form 8300 because, as usual, there are penalties involved. Not filling or interfering with filing can result in civil penalties (fines) or criminal penalties, which may include jail time.

To help you avoid such penalties and be a good citizen we put together this cheat sheet to help you know when to submit the proper paperwork.

F&I Software & Services Designed for Dealerships

Vera F&I software and services are specifically designed for vehicle dealers including automotive, truck, RV, marine, and power sports. Our F&I compliance solutions will help you develop compliant sales processes, train sales and finance teams, safeguard consumer information, and maintain clean deal jackets—all to help you minimize risk and maximize profits.