Exempt vs. Nonexempt: Sources of Confusion in California

Unsure if a California employee is exempt or nonexempt? Wondering what a wage order is and what to do with it? You’re not alone. These are common and potentially costly stumbling blocks for employers, especially those with California employees.

What’s the Difference?

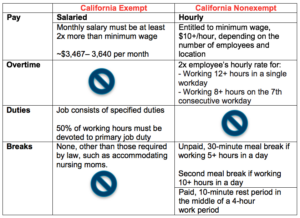

Exempt and nonexempt not only sound alike, but they are also so nuanced that even experienced HR professionals mix them up and may misclassify employees.

What’s the Fuss?

In California, employees are protected by both the federal Fair Labor Standards Act (FLSA) AND California’s Labor Code. Whichever wage and hour law is more favorable to employees is the one that supersedes.

Wage Orders

California wage orders explain the wage, hour and working conditions required for certain industries. There are currently 17 of them, covering everything from manufacturing to the movie industry.

Executive, administrative and professional exemption details are included in each wage order. Both salary and duty criteria details are part of the wage orders too.

By law, California employers are expected to know and abide by all wage orders as well as display them in an area where employees can access them.

Classification Status Can Change

California uses a qualitative duties test to determine if employees are considered exempt. Their status depends on whether they spend 50% or more of their time devoted to certain exempt activities. An employee devoted to these exempt activities this year may not still be doing the same tasks next year so their exemption status could change.

Phased Increases in Minimum Wage

California’s state minimum wage will increase gradually from now until 2022. For employers with at least 26 employees, the minimum exempt salary also goes up each year. Employers with fewer than 25 employees will have an additional year to comply with the new thresholds.

For more details, read KPA’s FAQs on Minimum Wage Laws in California blog post.

What Can You Do?

Keeping up with employee exemption classifications in California is a bit of work since they can change from year-to-year, but taking it step-by-step in an organized way will help you stay ahead of the game.

- Complete an annual audit.

Starting in September, get a handle on changes coming down the pipeline for the next year. Gather a list of your employees and their classification statuses and talk to managers to discuss what employees’ anticipated job duties will be next year. HR should also review managers’ classification statuses — just because they’re managers, they may not necessarily be exempt under California law. Last, determine which employees need to complete a new qualitative duties test or get salary increases.

- Ask an expert.

Sometimes it helps to be able to call for backup. Through KPA’s HR Solutions, certified HR consultants and attorneys are available to answer questions and review employee classifications.

- Consult reputable sources.

Credible organizations, such as SHRM and Lexology, are good sources to keep you up-to-date on the latest California regulations. KPA issues a California HR eNewsletter each month. And, of course, being familiar with the State of California’s Department of Industrial Relations is important too.

Additional Resourceshttps://kpallc.wpengine.com/insights/newsletters/